Maximum Contribution To 529 Plan 2025. Untaxed income to a student can reduce aid eligibility by as much as 50% of the amount of cash support. Unlike a payment made directly to an educational institution, a contribution to a 529 plan is considered a taxable gift—unless,.

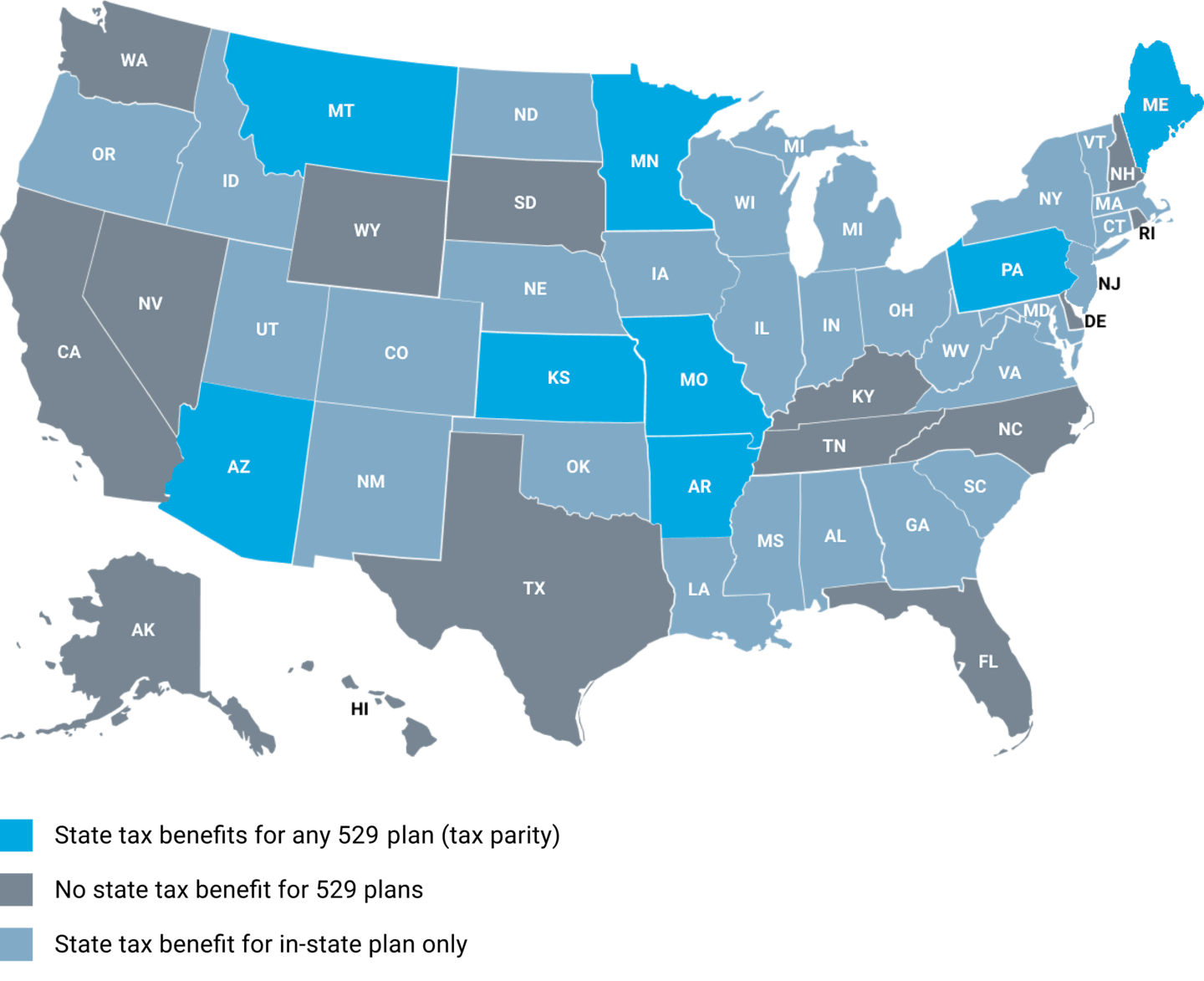

In 2023, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. Contribution limits varies by state;

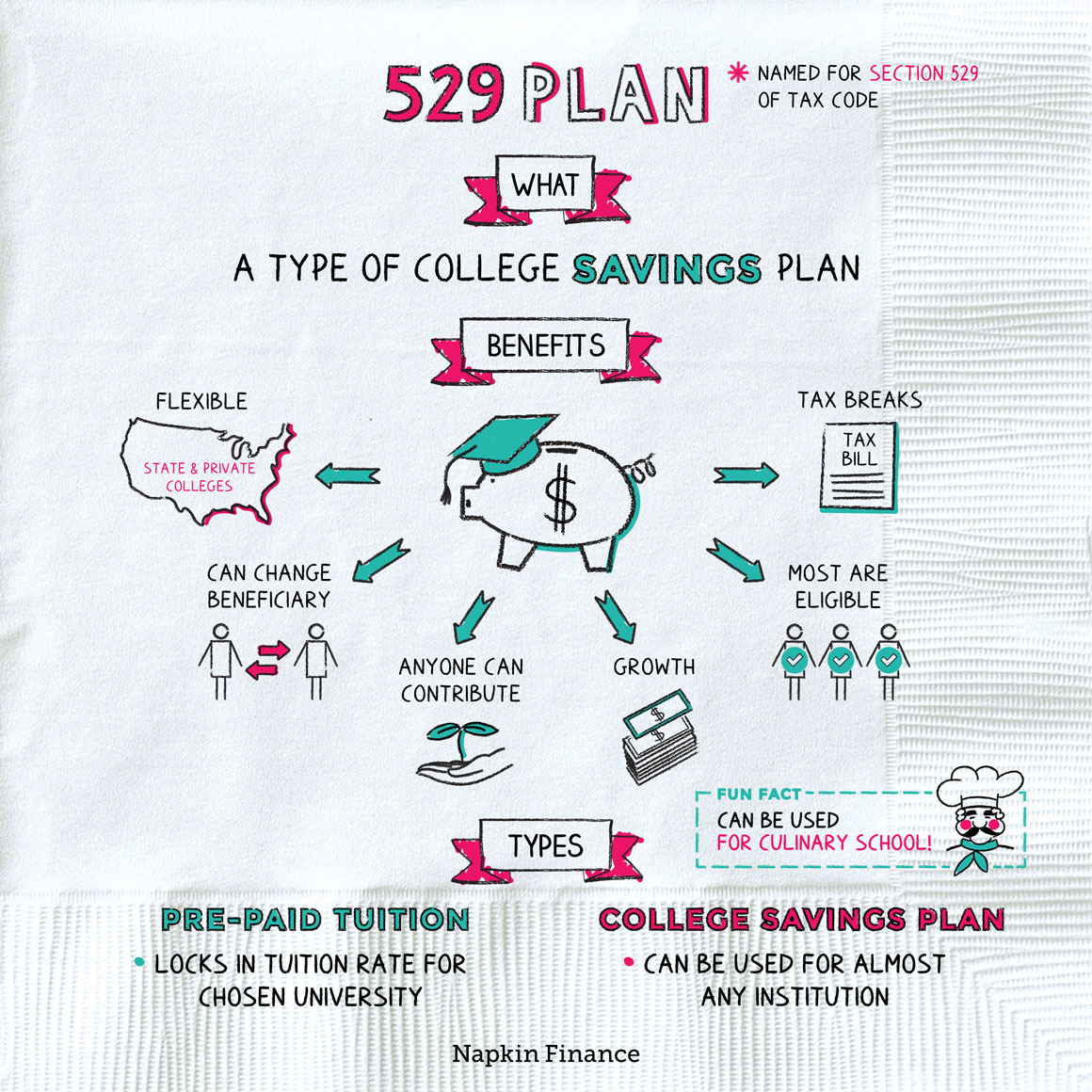

In this comprehensive guide, we will walk you through the ins and outs of 529 contribution limits, helping you navigate the complex world of education savings.

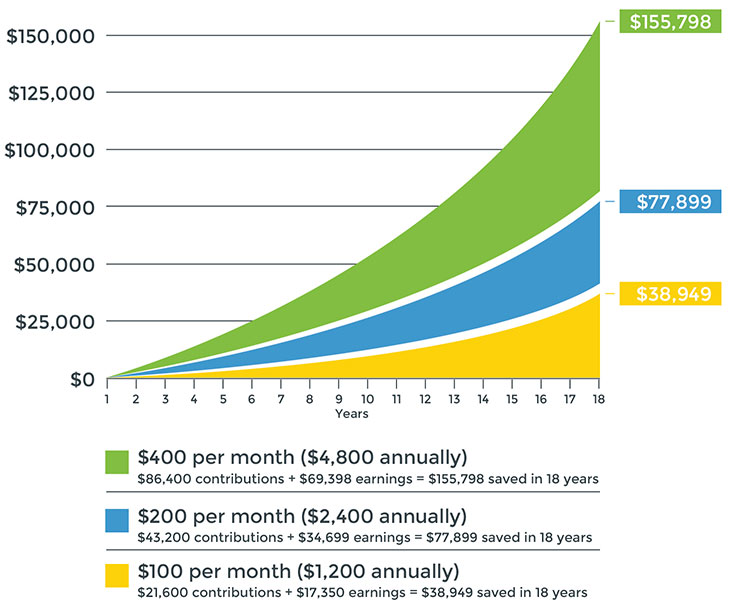

529 Plan Maximum Contributions YouTube, In addition to the annual limits, most 529 plans also have lifetime contribution limits. Last day to contribute to 529 plan for 2025.

529 Plan Contributions NEST 529 College Savings, 529 contribution limits are set by states and range from $235,000 to $575,000. Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a roth ira.

529 Plan Maximum Contribution Limits By State Forbes Advisor, 529 plans, legally known as “qualified tuition plans,” are. What’s the contribution limit for 529 plans in 2025?

Understanding 529 Plans Infographic, The 529 account must have been open for more than 15 years. In addition to the annual limits, most 529 plans also have lifetime contribution limits.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, 529 contribution limits are set by states and range from $235,000 to $575,000. Each state's 529 plan has a maximum aggregate.

529 Plan, Although these may seem like high caps, the limits apply to every type of 529. 529 plans have aggregate limits, the total amount you can contribute to the account per beneficiary.

What is a 529 Plan? Napkin Finance, You can contribute as much as you’d like to a 529 plan per year, but there are some caveats. In 2025, individuals can gift up to.

529 Plan Contribution Limits How to plan, 529 plan, 529 college, A state’s limit will apply to either kind of 529 plan: Last day to contribute to 529 plan for 2025.

529 Plan Maximum Contribution Limits By State shortthestrike, In addition to the annual limits, most 529 plans also have lifetime contribution limits. In this comprehensive guide, we will walk you through the ins and outs of 529 contribution limits, helping you navigate the complex world of education savings.

UGMA vs. 529 Plan Which is Better?, 529 plans have aggregate limits, the total amount you can contribute to the account per beneficiary. Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a roth ira.

Michigan Deer Baiting Ban Lifted 2025. Michigan’s deer population is out of whack, and hunters, […]